But…What About Cost-Benefit Analysis?

Milo Cress is an exceptional teen waging a campaign against plastic straws. His oft-cited statistic of 500 million straws a day used in America is almost certainly wrong, but for a back-of-the-envelope estimate, not far off enough to really matter.

What matters most is his (forgivable, for a 17 year-old) unawareness of the idea of cost-benefit analysis:

Mr. Cress, who will be a high school senior this fall in Shelburne, Vt., agrees that the precise number is less important than the waste: “We use far too many straws than we need to, and really almost any number is higher than it needs to be.” [emphasis added]

This kind of statement is what gets environmentalists in trouble and limits their impact.

Zero waste is not a good option. Zero waste means extraordinary poverty: no hospitals, no agriculture, no bookstores, etc. All human (and many animal!) activities produce waste. Even recycling produces waste!

Is “zero straws” a good use of time and energy? Could it actually be counter-productive? I can imagine people feeling great about all they are doing to save the environment by not using a straw. What about the larger benefits of other approaches?

If straws have negative externalities, why not simply internalize the externality with a corrective tax? Such a tax would be small per unit, and easily paid by people who really value straw use. Revenues could be used to tackle bigger environmental problems. In such a case, the best thing that could happen for the environment would be for straw use to increase, not decrease.

Environmentalists, listen: economics (like other sciences) is not your enemy. Learn it and put it to good use. The world is not a simple, black-and-white place where the most obvious wrongs are the most important ones to right.

Forgivable for a 17-year old…not for those who should know better.

Using Freedom Creatively

Melinda Anderson has a great article at the Atlantic on The Radical Self-Reliance of Black Homeschooling:

For VaiVai and many other black homeschoolers, seizing control of their children’s schooling is an act of affirmation—a means of liberating themselves from the systemic racism embedded in so many of today’s schools and continuing the campaign for educational independence launched by their ancestors more than a century ago. In doing so, many are channeling an often overlooked history of black learning in America that’s rooted in liberation from enslavement. When seen in this light, the modern black homeschooling movement is evocative of African Americans’ generations-long struggle to change their children’s destiny through education—and to do so themselves.

The Data Call for Optimism

Extreme poverty is set to fall below 10% of the world’s population.

“This is the best story in the world today,” said World Bank president Jim Yong Kim. “These projections show us that we are the first generation in human history that can end extreme poverty.”

Extreme poverty has long been defined as living on or below $1.25 a day, but the World Bank’s adjustment now sets the poverty line at $1.90 a day.

It would be interesting to see just how much of the drop in extreme poverty is attributable to economic reforms in China.

Spot the Unintended Consequences

Government enacts a price floor. What could possibly go wrong?

I hope my students can analyze this story using several of the concepts we’ve covered so far in class: segmented and non-segmented markets, incentives, binding and non-binding price floors, tax incidence, etc.

Why Elephants Are Endangered But Cows Aren’t, Exhibit #348

The fact that Texas has the “second-largest tiger population in the world behind India” should be good news for people concerned about the survival of tigers.

The fact that Texas has the “second-largest tiger population in the world behind India” should be good news for people concerned about the survival of tigers.

But not everyone is happy.

People who think more government regulation is the solution describe the situation as a “tragedy” that is “really very, very sickening to us.”

Others are sure that “People are not set up to provide the right kind of housing, a tiger’s proper diet and appropriate veterinary care.” Only people connected with the government can know these things, right?

Because if the government actually allowed private ownership of endangered animals, all kinds of terrible things could happen….like there now being “more tigers in the U.S. than there are left in the wild.”

Something tells me it isn’t “more tigers” that the regulators are bothered by, but that they despise the idea of private ownership as a solution to the tragedy of the commons. Such people have a sweetly naive view of the ability of governments to solve the problem of overuse of common resources.

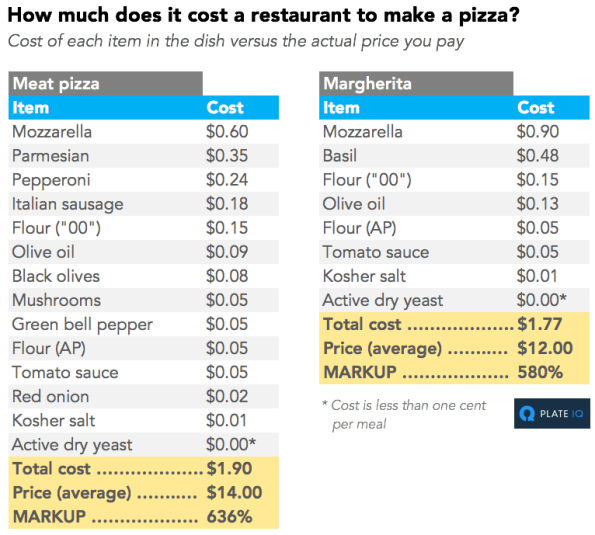

When Journalists Who Write about Prices Forget Opportunity Costs

It’s conventional wisdom: they’re trying to rip you off by overcharging you. But you can’t calculate the true cost of providing any cost or service without including opportunity costs. When Sally French says, “And you’re definitely better off making pizza at home,” I hope my students are asking as they read: “Really? Even people with high opportunity costs of making their own pizza?”

But, the Narrative…

Here’s another great example of “what everyone knows” not being supported by hard data. At a minimum, the idea that Chinese companies simply steal technology or force its transfer lacks nuance. How many of my students would guess that China may be the second largest licensee of technology?

Megan McArdle on Reducing Inequality

Some interesting observations here related to things we’ve been discussing in the Intermediate Microecomins class this past class session: discrimination, marriage as a way to fight poverty, role of government, etc.

Worth reading!

Export Bans as Price Control

A great post by Alex Tabbarok: A Visit to the Lasalgaon Onion Market. In class today we’ll discuss this:

When prices are high the government bans exports and blames farmers for hoarding (when prices are low as is true today, exports are allowed).

If You Want Less of Something…

…tax it.

This article illustrates several things we talk about in the introductory and intermediate microeconomics classes: derived demand, tax incidence, and the relationship between price elasticity of demand and close substitutes.

I hope my students can read it and apply these concepts to what they read.

China WeChat Fact of the Day

Marginal Revolution is always interesting, but when the title of the post is China WeChat Fact of the Day, I just have to point my students this way.

You could do worse things with your holiday than read Marginal Revolution, Baulding’s World, Cafe Hayek, Greg Mankiw’s blog, Johan Norberg or The Economist.

Better yet, read a book!

Midterm Grades

Midterm grades, ranked:

- Student: 8888; Midterm: 43

- Student: 1383; Midterm: 39

- Student: 8539; Midterm: 36

- Student: 4209; Midterm: 35

- Student: 2569; Midterm: 34

- Student: 2337; Midterm: 34

- Student: 8933; Midterm: 33

- Student: 6666; Midterm: 33

- Student: 7224; Midterm: 32

- Student: 9997; Midterm: 29.5

- Student: 2768; Midterm: 28.5

- Student: 1897; Midterm: 28

- Student: 2209; Midterm: 27

- Student: 6413; Midterm: 27

- Student: 1509; Midterm: 26.5

- Student: 7123; Midterm: 26

- Student: 2908; Midterm: 24.5

- Student: 7878; Midterm: 24 (median student: half scored better, half worse)

- Student: 5683; Midterm: 23

- Student: 6543; Midterm: 23

- Student: 1488; Midterm: 22

- Student: 1985; Midterm: 21.5

- Student: 1919; Midterm: 20

- Student: 1996; Midterm: 19

- Student: 1721; Midterm: 18

- Student: 1415; Midterm: 17

- Student: 1211; Midterm: 16

- Student: 9521; Midterm: 16

- Student: 1994; Midterm: 14

- Student: 4710; Midterm: 13.5

- Student: 2020; Midterm: 13

- Student: 2000; Midterm: 9

- Student: 1110; Midterm: 8

- Student: 7053; Midterm: 7.5

- Student: 6431; Midterm: 7

- Student: 9501; Midterm: 4

Good Advice on Dealing with Midterm Anxiety

Midterm Instructions

- The midterm will take place on November 18 from 10:45-11:15. After the midterm, we will begin Chapter 10.

- If you are late for the midterm, you will not receive extra time.

- No one absent from the midterm will be allowed to take a make-up exam.

- If you are absent from the midterm without excuse, you will receive a 0.

- If you are absent from the midterm with an approved excuse, you will receive a mathematically-estimated grade based on your performance in the class so far, relative to your classmates. For example, if your classmates so far have a median raw score of 160, and your median raw score so far is 80, then you are performing at 50% of class median. If the class median score on the midterm is 80, you will receive a 40 as the best estimate of how you would otherwise have performed had you taken the midterm. This only applies in the case of excused absences.

- If you don’t understand (4) above, show up for the midterm and it won’t apply. 🙂

- You can use your notebooks. If I see any loose papers in your notebook (i.e. not hole-punched into binders or glued or stapled very securely into the cheaper paper-only notebooks) you will not be allowed to use any notebook of any kind. Remove all loose papers from your notebook before you come to class.

- You may only use one notebook. You cannot use one notebook containing old quizzes and one containing your handwritten notes, for example. Take the time to make one professionally-organized notebook out of all your notes and papers.

- No calculators or phones are allowed for any reason, including translation. Feel free to put the translations for terms you have trouble understanding in English into your notebook.

- There will be only 30 questions, some easy, some hard. If you are not well prepared, you probably will not be able to finish all 30 questions. Excellent organization and preparation will help you complete the midterm within 30 minutes.

- Be prepared to answer questions on all 9 chapters we have covered so far. Any topic you have seen on a quiz or homework or active learning exercise is possible on the midterm. If you haven’t seen a particular topic on a quiz or homework assignment or in an active learning exercise, it won’t be on the midterm, even if it’s in the textbook.

- I will also include some very basic questions from these videos:

https://kelcyhahn.wordpress.com/2016/10/29/controls/

https://kelcyhahn.wordpress.com/2016/10/21/elasticity-2/

https://kelcyhahn.wordpress.com/2016/10/10/trade/

https://kelcyhahn.wordpress.com/2016/09/26/ppf/

Videos on Rent Control

To supplement the chapter we just covered on price floors and price ceilings…

This video isn’t as entertaining to watch–no fancy graphics–but if any of my students will listen in on this conversation with Thomas Sowell, there’s a good chance they’ll get smarter!

True or False?

I’ll give the answers in class on Wednesday. This is a good thing to put into your notebook!

- A government-imposed tax on a market reduces the size of the market.

- The incidence of a tax depends on whether the tax is imposed on buyers or sellers.

- Economic policies, like price controls, and taxes, often have effects that the people who created them did not expect them to have.

- A price ceiling is a legal minimum on the price of a good or service.

- If a price ceiling of RMB10 per litre is imposed on petrol, and the market equilibrium price is RMB7, the price ceiling is a binding constraint on the market.

- If a price ceiling is below equilibrium price, the quantity supplied will exceed the quantity demanded.

- Binding price ceilings benefit consumers because they allow consumers to buy all the goods they demand at a lower price.

- Prices are an efficient and impersonal way to decide who gets what.

- Because both the supply of housing and the demand for housing are more elastic in the long run, housing shortages caused by rent controls grow larger in the long run than in the short run.

- Rent control may lead to lower rents for those who get housing, but the quality of the housing may also be worse.

Price Elasticity of Demand Practice Quiz Answers

For my students: 1) 1; 2) 2; 3) 0.5; 4) 0.17; 5) 4.95% increase; 6) 12.6% increase; 7) 2.1% increase; 8) 0.3% increase; 9) 0.67; 10) 1.81; 11) 0.31; 12) 1.47.

When We Get to Oligopoly…

…remind me, students, of this news item. It’s a great example of the difficulty of getting members of a cartel to stick to their agreements to limit production in order to maximize total profits of the group.

Following yesterday’s latest IEA report which showed that OPEC production had hit an all time high, this morning OPEC released its own estimate of production by OPEC member nations for September and, not surprisingly, the latest report showed that in the month OPEC was supposed to be set on “cutting” production, the 14-nation group produced a whopping 33.39 million b/d crude in Sept., up 220k b/d from August.

Europe is Richer…AND Getting Greener

This very interesting article refers to several concepts we’ve touched on in the first few weeks of class, such as:

Expanding the PPF

As a result, Europe’s forests grew by a third over the last 100 years. At the same time, cropland decreased due to technological innovations such as motorization, better drainage and irrigation systems: Relatively fewer area was needed to produce the same amount of food.

Markets vs. government as the best way to organize economic activities, and how people respond to incentives

In eastern Europe, many forests re-grew after the end of the Soviet Union. Fuchs and his colleagues explain the development with the fact that many privatized agricultural farms were less competitive on the global market. Therefore, farmers abandoned unprofitable cropland. Particularly in Romania and Poland, former cropland was taken back by nature afterward, first turning into grassland and later into forests.

Trade and both absolute and comparative advantage

To the north of formerly communist Estonia, Latvia and Lithuania, Scandinavian countries were able to re-grow most of their forests (and are continuing to do so today) to keep up with timer demand, as they substituted most other suppliers in Europe that had practically used up most of their own wood resources.

Students who think economic growth is usually bad for the environment, requiring lots of government intervention, should at least consider that the real world might be more complex than what they’ve been told.

Read the whole thing.

Great Videos about Trade and Comparative Advantage

The first one is a simple and clear explanation of comparative advantage:

And here’s another one that uses the same kind of example, just a slightly different situation and adds some new material:

PPF Video

Here it’s called Production Possibilities Curve, but it’s the same thing as the PPF we’re talking about in class:

Graphing Review Video

This is a great review of graphing for students who need help in this area:

Ten Principles of Economics Video Review

This video will help freshman students review the text’s first chapter, Mankiw’s 10 principles of economics:

This is prepared for a U.S. classroom, so all the examples are from the U.S. Hopefully my students can think of examples from their own countries, too.

I, Pencil

A great video introducing economics from another prespective–that of wonder at the way markets actually work to deliver goods of great complexity with great efficiency.

I plan to show it in my Introduction to Microeconomics class this week.

Leading African Entreprenuers

A student called my attention to the Ethiopian commodities exchange market and Eleni Gabre-Madhin’s work there (she’s since left to start a new venture).

Here’s a link to some TEDx talks by other African entrepreneurs my students may find interesting.

Brexit Commentary

Though I am generally quite positive towards freer trade, economic ties as a way to secure peace by making war too expensive for elites, and freer movement of people across borders, I think it’s a mistake to think Brexit will have catastrophic effects.

Some thoughts:

(1) If economic specialization is good, why isn’t political and cultural specialization also beneficial? Suppose Germany stays very open to immigration and the UK becomes more closed. Isn’t this a good experiment on the economic and cultural impact of more (or less) open borders? Shouldn’t we have a little humility about what we do and do not know with regards to the impact of freer movement of labor?

(2) I suspect the UK will become very focused on making trade deals with a number of trading partners besides the EU. Feels like competition–of a positive kind–to me.

(3) This may help those within the EU who want to focus more on trade and economics and less on political union to gain clout. The EU people are smart and will make adjustments.

It’s really out of my area of expertise, though. Here’s some commentary by people smarter than me:

Brexit impact on China: Christopher Balding, but see this from an unnamed APF stringer.

Good Question!

Things for my intermediate microeconomics students to ask themselves going into the final:

- Can I graph the effects on equilibrium price and quantity of changes in supply and demand? Can I identify which events will shift which curve, and in which direction?

- Do I understand the concepts of substitutes and complements? Can I use these concepts to analyze how markets will react to different changes?

- Can I graph binding and non-binding price ceilings and floors? Do I understand how to measure shortages and surpluses on a graph?

- Do I understand the properties of indifference curves? Can I recognize indifference curves for perfect substitutes and perfect complements?

- Could I create a demand schedule?

- Can I correctly graph a demand schedule, a supply schedule, a production function, a PPF, and a budget constraint line?

- Do I understand the meaning and significance of the beauty premium, superstar phenomenon, in-kind transfers, bundles of consumption, derived demand, world price, small market assumption, tariff, tax incidence, the ultimatum game, asymmetric information, the signalling theory of education, hidden characteristics, hidden actions, moral hazard and marginal cost and benefit?

- Do I understand the difference between price discrimination and racial discrimination? Between positive and normative statements? Between movement of the curve and movement along the curve?

- Can I accurately calculate the slope of a demand curve or a budget constraint line?

- Do I understand MPL and MRS?

- Do I understand the difference between PPFs that are straight lines and PPFs that bow outwards?

- Can I give examples of perfect (or nearly perfect) substitutes and perfect (or nearly perfect) complements?

- Do I understand the difference between a shift in the budget constraint line and a pivot? Can I graph the effects of a price increase or decrease or an income increase or decrease on the budget constraint line? Can I show how this might change consumption preferences?

- Do I know how to calculate the slope of a budget constraint line? Can I calculate the marginal rate of substitution between two points?

- Do I understand the difference between substitution and income effects, and the substitution and output effects? Do understand what an isoquant curve is?

- Can I graph diminishing marginal utility of income and evaluate “fair” prices for insurance?

- Can I graph the trade-offs in consumption today and in the future? Do I understand why in some cases an increase in interest might increase savings, and in some cases decrease it? Could I graph that?

Good Questions!

A consumer has income of $9,000. Coffee costs $3 a cup and pastries cost $2 each. Draw the consumer budget constraint. What is the slope? What would happen if income rises to $12,000? What would happen if the price of coffee falls to $2 per cup? What would happen if the price of pastries rises to $4.50 each?

What is the consumer indifference curve for 1 yuan notes and 1 yuan coins most likely to look like?

What are the four properties of indifference curves?

Analyze This

There’s a lot more than minimum wage going on here:

Wendy’s (WEN) said that self-service ordering kiosks will be made available across its 6,000-plus restaurants in the second half of the year as minimum wage hikes and a tight labor market push up wages.

It will be up to franchisees whether to deploy the labor-saving technology, but Wendy’s President Todd Penegor did note that some franchise locations have been raising prices to offset wage hikes.

McDonald’s (MCD) has been testing self-service kiosks. But Wendy’s, which has been vocal about embracing labor-saving technology, is launching the biggest potential expansion.

Wendy’s Penegor said company-operated stores, only about 10% of the total, are seeing wage inflation of 5% to 6%, driven both by the minimum wage and some by the need to offer a competitive wage “to access good labor.”

It’s not surprising that some franchisees might face more of a labor-cost squeeze than company restaurants. All 258 Wendy’s restaurants in California, where the minimum wage rose to $10 an hour this year and will gradually rise to $15, are franchise-operated. Likewise, about 75% of 200-plus restaurants in New York are run by franchisees. New York’s fast-food industry wage rose to $10.50 in New York City and $9.75 in the rest of the state at the start of 2016, also on the way to $15.

Wendy’s plans to cut company-owned stores to just 5% of the total.

Still, Penegor said that increased customer counts more than price hikes drove the chain’s 3.6% same-store sales increase in the first quarter.

Although profit exceeded Wall Street estimates, Wendy’s shares dived nearly 9% Wednesday because of weak second-quarter sales.

Besides modeling the effect of minimum wage increases, there’s a lot of interesting things we can get into using this semester’s topics. Be ready to discuss (and model) factor substitution, the relationship between revenue, prices and profits, time value of money and short and long term price elasticity.

Class Videos on Asymmetric Information

On the car market as an example:

Economics of natural disasters: Moral hazard, government intervention and insurance:

Freakonomics Asks: Does your real estate agent have your best interest in mind?

Think About Earnings and Discrimination

I recommend students take the time to write thoughtful answers to these questions in their class notebooks:

- Why do coal miners get paid more than other workers with similar education?

- In what sense is education a type of capital?

- How might education raise a worker’s wage without raising the worker’s productivity?

- What conditions lead to economic superstars? Would you expect to see superstars in dentistry? In music?

- Give three reasons a worker’s wage might be above the level that balances supply and demand.

- What difficulties arise in deciding whether a group of workers has a lower wage because of discrimination?

- Does the profit motive tend to make the practice of discrimination based on race more common or less common? How?

- Give an example of how discrimination might persist in a competitive market.

Practice Problem on Markets for Factors of Production

| Workers | Output | MPL | VMPL | Wage |

Marginal Profit |

|

0 |

0 | ||||

|

1 |

100 | $1,000 | $500 | $500 | |

| 2 | 80 | $ 800 |

$500 |

||

|

3 |

60 | $500 |

$100 |

||

| 4 | 280 | $ 400 |

$500 |

||

| 5 | 20 | $500 |

- What is the market price of the final good?

- When does increasing marginal product occur?

- If the firm hires two workers, how much do the two workers together produce?

- What is the marginal product of the fourth worker?

- What property is exemplified by the fact that the marginal product falls as the number of workers increases?

- The fact that the production function exhibits diminishing marginal productivity implies that total production ______________ (decreases or increases?) beyond a certain level of output.

- What is the marginal profit of the fourth worker?

- What is the fourth worker’s contribution to total revenue?

- To maximize its profit, how many workers will the firm hire?

- To maximize its profit, the firm will hire workers as long as the value of the marginal product of labor equals or exceeds $___?

Fun Theory, or “People Respond to Incentives”

It’s a cool idea and upbeat video…but is it really any different from “people respond to incentives?”

What Damage the U.S. Raising Tariffs on Chinese Products Will Do

It would be bad for the U.S. and bad for China:

…the Chinese government’s response would probably be tariffs of its own on American goods and services rather than lowering barriers for American companies doing business in China. It moved quickly to retaliate for the tariff on Chinese tires with punitive duties on American products. Because the Chinese market has become critical for many American companies — whether Apple, Starbucks or Boeing — any steps taken by the Chinese government to curtail their ability to operate in China would be bad news for them.

This might be good for India, Vietnam, Bangladesh and other countries to which at least some of the production happening in China is likely to shift.

The Rule is a Tool

David Colander is critical of what he considers the insufficiently nuanced way Mankiw presents economics to freshmen students. Mankiw’s response is here. (H/T Marginal Revolution)

Not surprisingly, I tend to side with Mankiw on this, but for a different reason.

It’s not that students know nothing about economics and therefore must be taught the basics before learning nuance.

The problem is that they have to unlearn a hyper-relative approach to the world in which everything is questioned and doubted to the point of not being able to make any useful claims about reality. The answer to everything is some version of “it depends on your point of view” or “I feel” or “perception is reality” or “maybe that’s true for you, but for me…”

The idea that no one can make useful claims to knowledge is not a nuanced view of reality. It’s a view that inhibits learning.

Of course, all knowledge claims should be subject to scrutiny. Everything we know is qualified in one way or another. But what Mankiw does well, in my opinion, is give students a window into a world where you can actually gain knowledge about how the world works. Not perfect knowledge or simple answers, but something to work with, something to predict with, something to put confidence in as a useful tool.

If Colander thinks modern students just swallow rules whole in economics class, I rather doubt he’s working with actual freshman much. My freshmen students have trouble believing that there are any rules. They have a extreme skepticism that one can make any claims that would stand up to someone who merely says, “But I don’t feel that way.”

For many of them, Mankiw’s approach is a breath of fresh air, after being constantly told that there’s nothing really to be learned, only positions to be taken based on one’s feelings about some matter or another.

Congratulations, Jones Graduate School of Business!

With apologies for my somewhat self-interested promotion of this good news:

The Rice MBA is the only full-time MBA program in the last decade to go from below the top 40 to the top 25 in the U.S. in all three top rankings of business schools: from 2006 to the present, Bloomberg Businessweek, from unranked to No. 19; U.S. News, from No. 44 to No. 25; and Financial Times, from No. 41 to No. 24 (in the U.S.).

The Jones School’s graduate entrepreneurship program was ranked No. 14 in U.S. News’ MBA specialty rankings.

I’ll always be very thankful that I had the opportunity to learn from some really excellent teachers (and fellow students) in this program. Glad to see it continuing to do so well in a very competitive environment.

Moving the PPF Out

I mentioned in class yesterday that I thought the U.S. had become the world’s largest hydrocarbon producer, surpassing Saudi Arabia. But I didn’t have the actual figures at hand; here they are for interested students:

The United States remained the world’s top producer of petroleum and natural gas hydrocarbons in 2014, according to U.S. Energy Information Administration estimates. U.S. hydrocarbon production continues to exceed that of both Russia and Saudi Arabia, the second- and third-largest producers, respectively. For the United States and Russia, total petroleum and natural gas hydrocarbon production, in energy content terms, is almost evenly split between petroleum and natural gas. Saudi Arabia’s production, on the other hand, heavily favors petroleum.

Class Videos on GDP and Standard of Living

First, on real GDP and standard of living:

Second, growth miracles and disasters:

- Is GDP is good measure for standard of living? Why?

- What does GDP not measure well?

- What usually happens to the incomes of poor people when a country’s GDP grows?

- What does the “hockey stick” mean?

- Which countries have similar GDP per capita but very different distributions of income?

- What’s the difference between GDP and GDP per capita? How is GDP per capita calculated?

- What are some example of countries that have “caught up” quickly with the countries with the highest standards of living? What are some example of countries that have not caught up?

Always The Optimist

Actually, I don’t see myself as a China optimist. I just think the most realistic view is a positive one.

I have several questions for the pessimists. When someone says:

But we do know that the vast global network of mines, roads, agricultural development, and financial speculation built on the assumption that the old Chinese economy would grow at eight percent forever is running on empty.

I have to ask: was there really a lot of money invested on the assumption of 8% growth forever? Sure, some investing is irrational and can create over-capacity. But I doubt that any really big investors used “8% forever” as their basis for decision making.

Is is possible that, having seen the Chinese economy grow quickly for a far longer period of time than expected, investors were acting rationally? That they risked over-shooting by a few percentage points rather than under-shooting because it made sense in an economy that consistently grew faster for longer than had ever happened in recent history?

And does it really matter? So what if the Chinese economy doesn’t grow at eight percent a year? If it keeps growing at all, but on an ever-increasing base, won’t a lot of that demand materialize sooner or later?

But we have not yet hit bottom. The new reality of a much slower growth in China’s demand for basic manufacturing inputs is still young and its impact is only now beginning to be felt.

But…what if it is a good thing that there is “slower growth in China’s demand for basic manufacturing inputs?” What if that just means that, as China’s productivity is growing and its economy is maturing, it’s moving out of basic manufacturing?

That would mean China will demand many more goods produced from “basic manufacturing” relative to the goods it’s producing in basic manufacturing. That sounds like lots of imports to me. Those imports will have to be produced somewhere–probably they will be spread over a number of smaller economies that are able to gain comparative advantage in the manufacture of basic goods.

Really, which is more likely: that global demand for “basic manufacturing inputs” will move from China to…nowhere? Or from China to Bangladesh, Vietnam, India, Ethiopia, Tanzania?

Will that really be a bad thing?

For anyone?

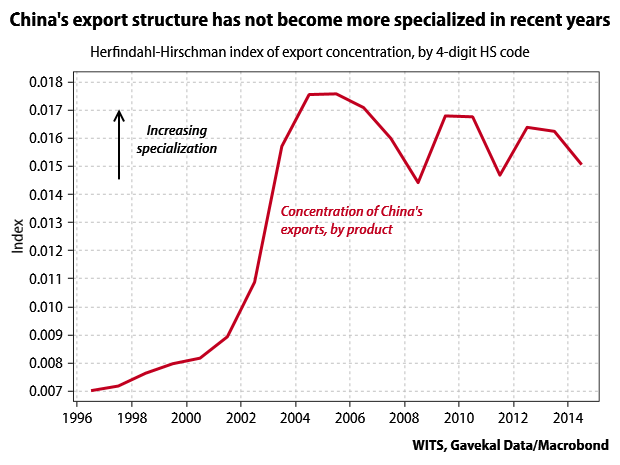

Domestic Market Size and Export Specialization

A puzzle:

Exports have been growing, and China’s global market share has been rising until very recently. So China has generally been steadily becoming a more successful exporter. But as this has happened it has not shown much sign of becoming more specialized in particular types of products, which is usually one of the things that happens in countries that are successful exporters.

A possible explanation:

But perhaps, as Carsten suggests, the issue is more fundamental, and one we have not really encountered before: China’s export industries might already large enough, relative to total world demand, that even a very successful export performance will not show up as much specialization. This is one to ponder further.

(I really want to teach International Economics again.)

Great Video on Growth Rates

How do I work this video into a class?

The subject is just too important to ignore. If you want more health care, more nutrition, more education and more resources for protecting the environment, it’s crazy not to discuss the central role of economic growth: